-

The proposed Joint Council Committee for the Waitakere Ranges Parkland

The consultation on the proposed Deed of Acknowledgement between the Crown, Auckland Council and Te Kawerau ā Maki will end shortly. The closing date for feedback is April 28. There has recently been distributed locally a pamphlet from an organisation called Democracy Action which makes these claims: The proposed joint committee would grant decision-making power…

-

Dumbing down the City Rail Link

The City Rail link is close to completion and is ready to properly open in early 2026. The original vision needs to be restated. The CRL will allow the Britomart’s throughput to double. Instead of being a terminating station it would become a through station. And instead of its capacity being maximised in a few…

-

Chair’s report – March 2025 – Local Board priorities this year

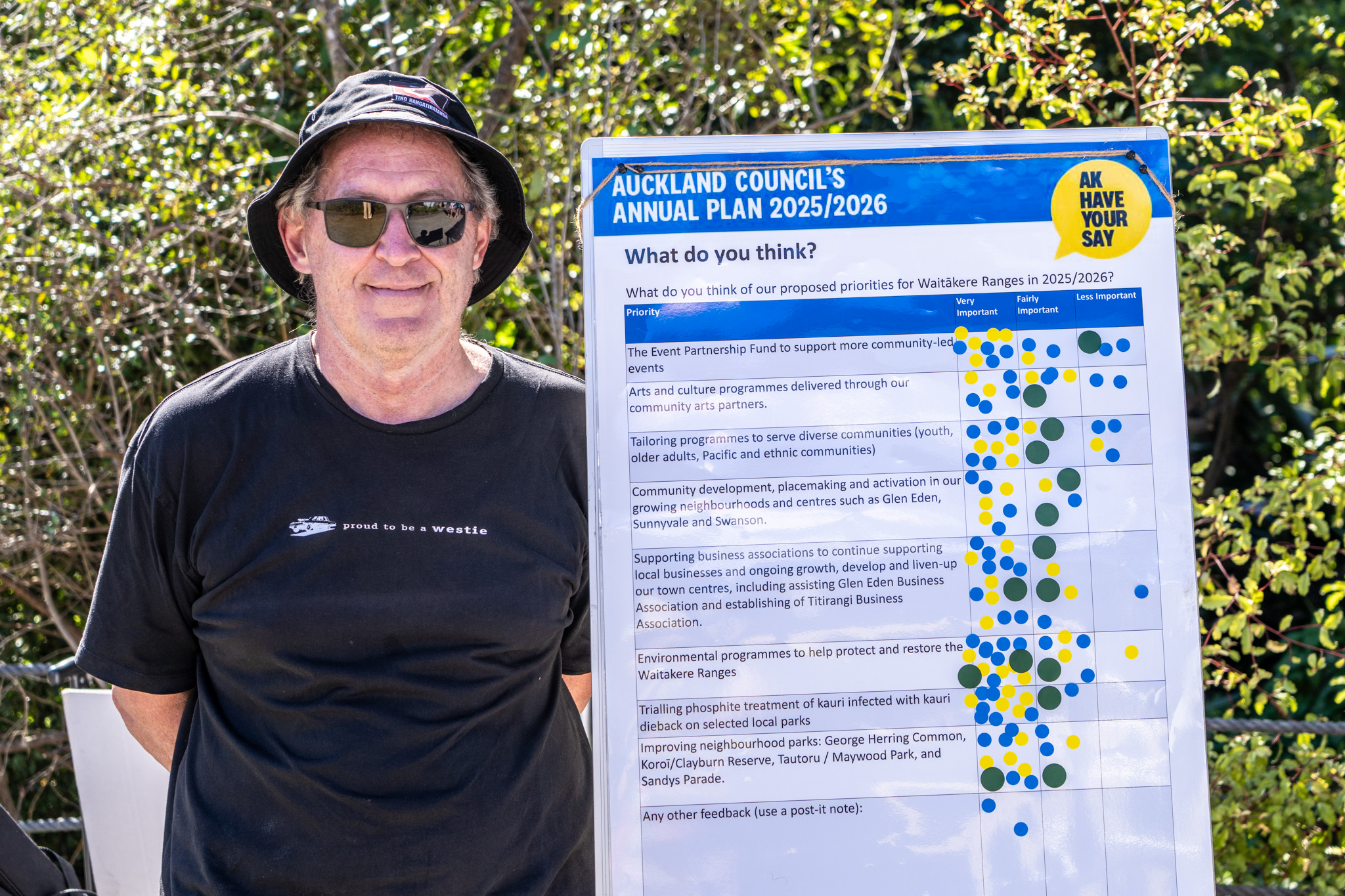

Consultation on Annual Plan and Local Board priorities Council and the local board are consulting on the current draft annual plan and the local board’s priorities. The two questions Council is asking is what do people think of the draft plan and what do they think about the proposed visitor levy to be used to…

-

Chair’s report – Waititi at Waitangi and looking after Te Atatu library staff

Waitangi at Waititi One of the highlights of the local board’s calendar is the Waitangi at Waititi event. For a number of years now Hoani Waititi Marae and Te Whānau o Waipareira have hosted this event on Parrs Park on Waitangi Day. The event starts with a pōwhiri where guests are welcomed onto the marae.…

-

Waitākere Ranges Local Board Submission on the Principles of the Treaty of Waitangi Bill

Following is the local board submission made on the Principles of the Treaty of Waitangi Bill. The Waitākere Ranges Local Board submits as follows: Introduction The Waitākere Ranges Local Board has taken an active interest in issues regarding Māori. Our rohe includes the ancestral land of Te Kawerau ā Maki and we treasure our relationship…

Got any book recommendations?