At the risk of being described as financially illiterate I thought I would revise my earlier post and set out why I think Auckland Council selling its airport shares is a particularly silly thing to do and why Council’s finances are not in a status of crisis.

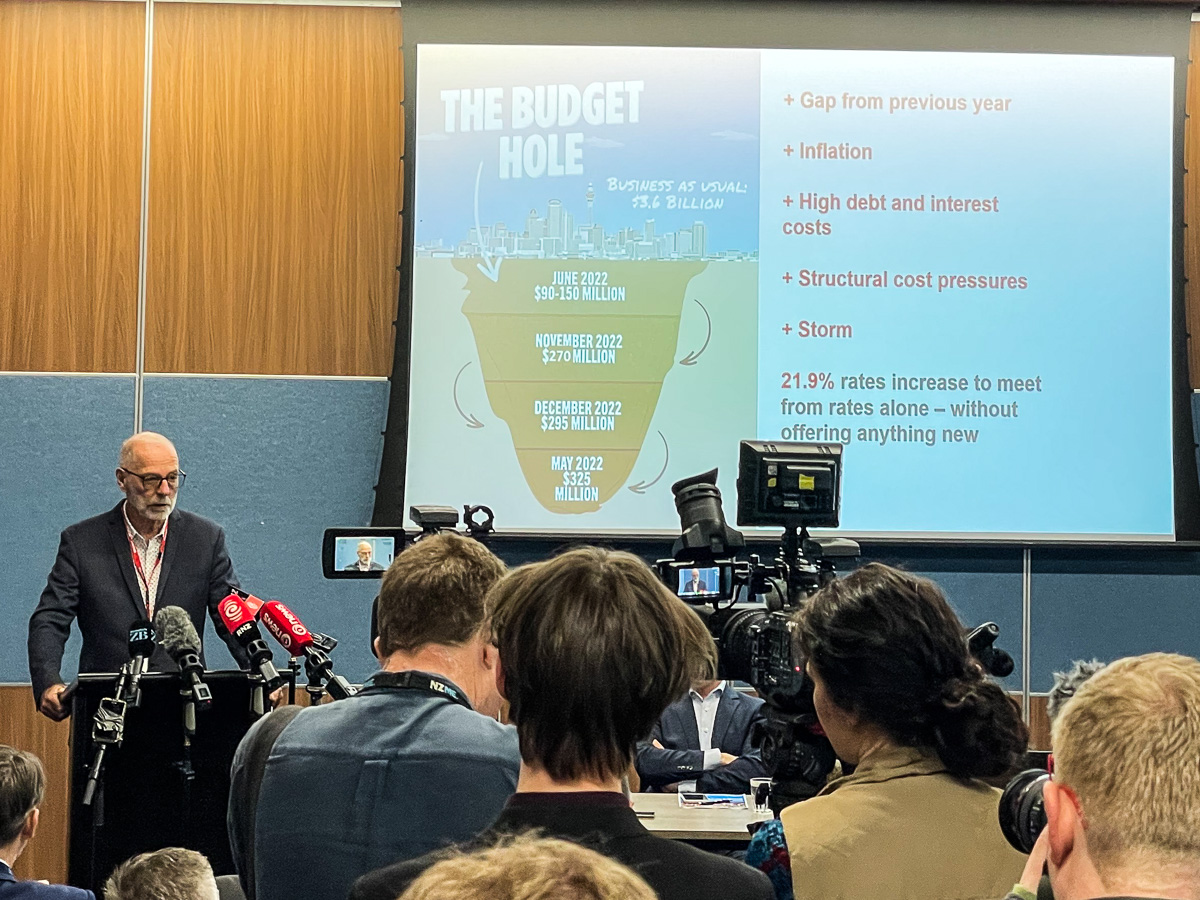

There has been a lot of talk suggesting that the Council is in a financial crisis. Debt is apparently out of control and there is a “massive” deficit that needs to be resolved.

I don’t share that level of concern. The figures are large but so is Council’s overall asset base.

The last Annual Report indicated that assets were $70.4 billion and borrowings were $11.4 billion.

This is like a household having a million dollar house and a $162,000 mortgage.

And the debt to revenue ratio, as shown by this graph, is within Council’s usual expectations. During Covid Council decided to allow debt to go up to 290% of revenue. It less than 250% currently. Using my earlier household analogy this is like a family having a million dollar house, a mortgage of $162,000 and income of $65,000 per year.

So do we actually need to sell the shares?

In my view there are a number of reasons why we should not.

Historically the shares have performed well. Apart from the Covid period they have consistently provided dividend revenue and they have also appreciated considerably in value since the beginning of Super City as this graph shows.

They dipped during Covid but since the lockdowns have ended the shares are moving up in price. Following is a graph showing the share price over the past 12 months. As can be seen their value has significantly increased over the past six months. The 200 day moving average trend (grey line) is strongly positive. Given their historical performance and their recent performance now may not be a good time to sell.

For an entity that has not paid a dividend for a couple of years AIAL’s share price is surprisingly resilient. And I would have thought that the prospect of 18% of a public company’s shares hitting the market would cause nervousness. But the price is clearly trending upward.

Repeating the household example this is like a family having a million dollar house, a mortgage of $162,000, income of $65,000 per year and Kiwisaver worth $31,800. Except you get about $650 a year paid into your bank account as well as the capital gains.

And the income from the dividends is expected to increase significantly in the next few years. This graphic from a Council shows the analysis which backs the claim that the sale is the appropriate thing to do.

There are two things to note about the analysis. First of all the anticipated interest cost savings are static, despite interest rates being predicted to drop significantly in the next few years. This graphic from the recent Government budget shows by how much.

I appreciate that Council’s finances are complex and that the use of derivatives smooths Council’s interest rate out but to not allow for a reasonably significant reduction in the interest saved by applying any share sale proceeds to debt over time appears to me to be wrong.

And on the income side there is a healthy increase in dividend income until 2028 when the anticipated income flattens. This graph shows Council’s projected increase and what would happen if the gains for the first four years were extrapolated out.

I understand this is because staff anticipated that following 2028 increases would match the rate of inflation. With respect this is very cautious.

The graph indicates that there is a short term benefit in selling the shares and paying down debt. But after a few years of anticipated dividend growth Auckland Council and the region will be all the poorer for any decision to sell.

And it raises into question the Mayor’s rhetoric where he says that selling the shares will save the Council $100 million each year in interest costs. The net figure in year one is $58 million and it then keeps going down, even on Council’s figures.

One other figure, currently Council spends about 10% of its income on interest payments. Given Auckland’s growth and the need to provide infrastructure using borrowing to achieve this is not unusual.

There were other interesting aspects to the Mayor’s budget. He announced further funding for bus driver salaries to move their salaries to $30 per hour. Interestingly this matched the proposal made by Central Government in the recent budget. I wonder who is actually funding it?

He also wants to reduce the Natural Environment Targeted Rate. Given the environmental challenges facing the city in my view now is not the time to do this.

If I had control of the Council’s finances I would accept the Mayor’s proposed savings of $70 million, pump up the increase in rates to 10% to realise a further $110 million and borrow the balance of $145 million. The debt to income ratio would increase to just over 250% but would still be within currently allowed parameters.

And Council does not have to balance the books. Sudden shocks such as two one in five hundred year storms within a week of each other can justify more radical steps being taken.

Selling the shares will in the long term undermine the city’s ability to develop and maintain its assets. Big corporations are lining up to purchase the shares because they realise that in the long term they are a good buy.

I trust that Council will do the right thing this week and keep the shares. And I wish that the decision making process adopted was more conciliatory and less confrontational.

Leave a Reply